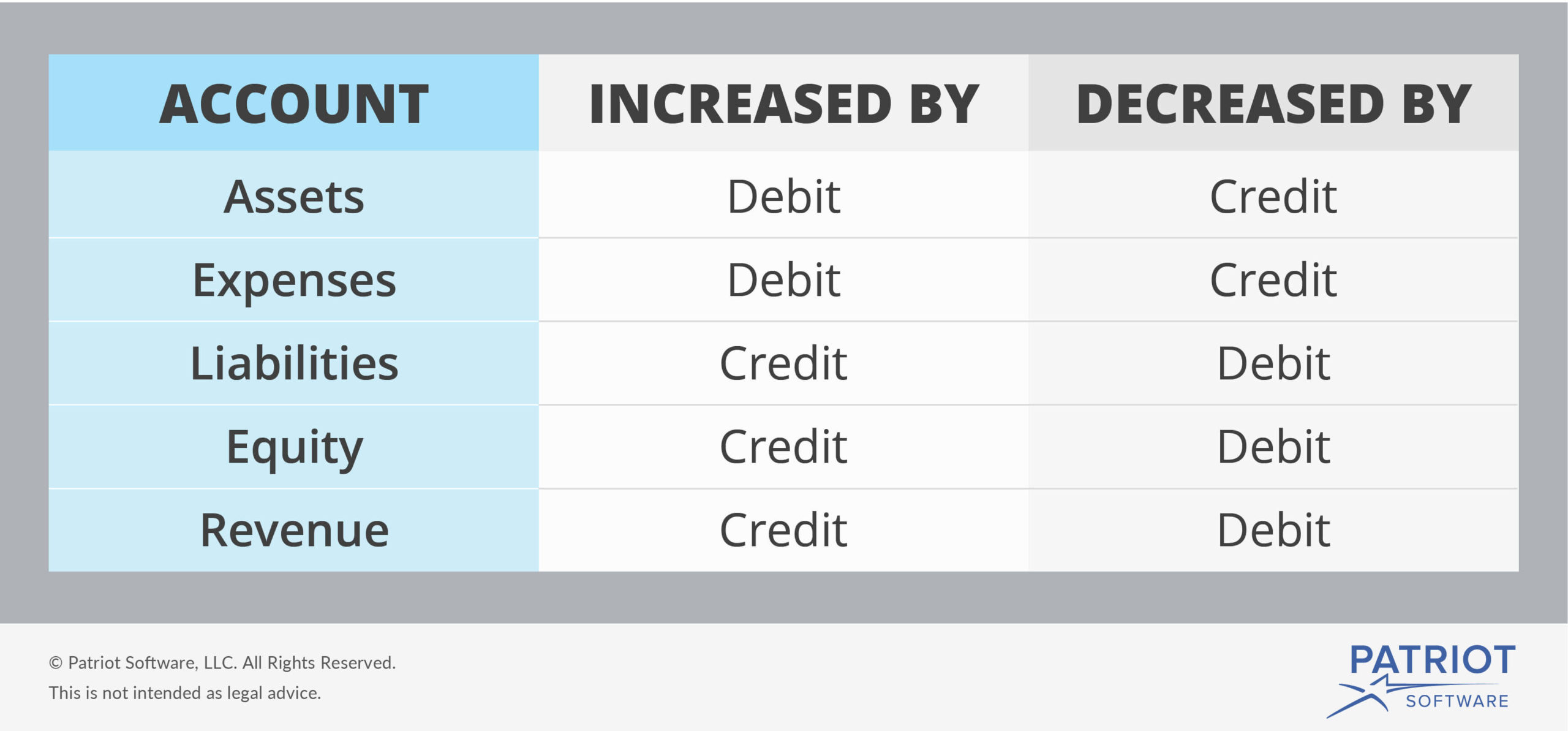

Larger obligations, such as pension liabilities and capital leases, are instead usually tracked under long-term liabilities.ĭebts marked under accounts payable must be repaid within a given time period, usually under a year, to avoid default. The items purchased and booked under accounts payable are typically those that are needed regularly to fulfill normal business operations, such as inventory and utilities. Restrictive clauses (e.g., no stock buybacks or dividend payments)Īccounts payable is a liability account recorded on a company’s general ledger that tracks its obligations to pay off a short-term debt to its suppliers and lenders. Notes payable often come with various additional terms, such as: There are no payment obligations to creditors other than the repayment of the principal within a year. There are typically no specific terms under a company’s accounts payable. The company issuing the promissory note and its lender may agree to a due date longer than one year ahead.Īdditional terms. Notes payable, in contrast, can be classified as either a short-term or long-term liability.

Each amount credited is due and payable within 12 months. Accounts payable are always booked as a short-term liability on a company’s balance sheet. Notes payable may or may not be taken into account in calculating working capital, depending on whether it’s booked as a current or non-current liability. Accounts payable are always a vital component during the calculation of working capital. The amounts of money involved are often much higher and for riskier investments, like buying a new business property.Ĭalculation of working capital. Notes payable are created for high-risk situations that demand a formal contract. If a company has good credit or is already an established business partner, there is low risk involved with lending them money. Transactions recorded in accounts payable are often between two trustworthy companies. Notes payable often represent significant borrowing for long-lived assets such as buildings, equipment, and other costly infrastructure. Accounts payable usually represent normal day-to-day business expenses, such as raw materials and inventory. On the other hand, accounts payable typically represent amounts due to suppliers and vendors of a company. The amount debited to a company’s notes payable is usually received from banks, credit companies, and other financial institutions. Notes payable can never be converted into accounts payable. Lenders may decide that it’s a better idea to convert the amount owed to notes payable rather than pursue immediate legal action. This typically happens if a company decides it’s unable to fulfill its short-term debt obligations. Accounts payable may be converted into notes payable upon agreement between a company and its vendor. Notes payable always involves a formal contract that contains a direct written promise to pay off a loan.Ĭonversion.

Supplies and services are simply bought on credit and then paid off within a promised period of time, up to a year away. Both parties will enter a verbal agreement on when the amount is expected to be paid. Accounts payable involve no written agreements between a company and its vendors. Show More What Is the Difference Between Notes Payable and Accounts Payable?Īlthough notes payable and accounts payable are both liability accounts that represent the amounts payable to creditors, there are several significant differences between the two: Difference Between Generalist Vs Specialist.What Is The Difference Between A Job Vs.

0 kommentar(er)

0 kommentar(er)